Bank Routing Number Lookup

An ABA number, also known as a bank routing number, is a nine-digit code that identifies banks in the U.S. That number helps other banks transfer money to and from checking accounts for transactions like direct deposit and automatic bill payments.

A routing number, ABA number, or Routing Transit Number (RTN) is used on checks and other financial documents to identify your bank.You can find your bank's ABA Routing Number with the Routing Number Lookup tool. Enter a bank name, location, or phone number to search the full routing number directory. By clicking 'Agree,' I acknowledge that I have read and agree to the Federal Reserve Banks' terms of use for the E-Payments Routing Directory. If I am entering into. Bank of America routing numbers are 9-digit numbers assigned by the ABA. Routing numbers for Bank of America vary by state and transaction type. The routing number is based on the bank location where your account was opened. You can find the routing number quickly on the bottom and left side of your checks.

ABA Origins

Back in 1910, the American Bankers Association (ABA) created ABA numbers as a way to assign unique identifiers to each payment-issuing bank. This security process allowed banks that deposited customers' checks to verify the legitimacy of the originating bank that issued the check and held the funds. After the creation of the Federal Reserve, the ABA number was expanded to include another identifier, known as the Federal Reserve Routing Number.

Find and Use ABA Numbers

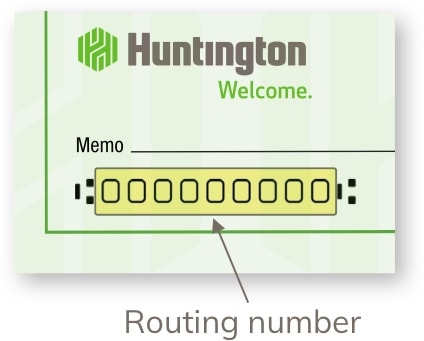

You can get your account’s ABA number from several sources. If you have a checkbook handy, the easiest approach is to read the numbers from the bottom of one of your checks.

On paper checks: An ABA number is printed on every check. It is usually the nine-digit number in the bottom left-hand corner, although it might appear elsewhere on computer-generated checks (like online bill payment checks or business checks). You can also find your ABA number on deposit slips, typically in the same location.

Contact your bank: Some banks provide this information online, although you might need to log into your account to find the right number. Search your bank’s website for direct deposit forms or Automated Clearing House (ACH) information or give them a call.

Use the correct number: Your bank may have several ABA numbers, so it’s essential to use one specific to your account. ABA numbers may differ depending on where you opened your account, and bank mergers can result in multiple codes for the same bank. Some banks also use separate ABA numbers for wire transfers vs. direct deposit or ACH transactions.

Even if you know the correct number for ordering checks, you might need to use a different number for wire transfers and electronic bill payments, so when in doubt, ask a customer service representative at your bank which number to use.

How ABA Numbers Work

For the most part, all you need to do is copy your ABA number and provide it to whoever is asking for it—banks handle the logistics after that. Provide that number, along with your account number, to your employer or whoever else needs the number for automatic transfers.

If your bank fails or merges, you may get new ABA numbers—but you don’t necessarily have to start using them right away.

Ask your bank if you can continue using the old numbers until you order new checks or sign up for new services. In most cases, you can continue using old routing numbers indefinitely.

ABA numbers use an intricate system:

Behind the name: An ABA number is like an address that tells everybody where to find your account. As a result, ABA numbers may also be called routing transit numbers (RTNs) or check routing numbers.

Computer-readable: Routing numbers are typically printed on checks using magnetic ink, which allows special machines to read the code more easily. Whether or not magnetic ink is present, the numbers are written in MICR font, making it easy for computers to recognize the numbers (when you deposit a check by snapping a photo with your mobile device, for example).

The first four digits were initially assigned by the Federal Reserve Routing System and represent the bank's physical location. Because of acquisitions and mergers, these numbers frequently do not correlate with the bank’s geographic location today.

The fifth and sixth digits designate which Federal Reserve bank the institution's electronic and wire transfers will route through.

The seventh digit denotes which Federal Reserve check processing center was initially assigned to the bank.

The eighth digit designates which Federal Reserve district the bank is in.

The ninth digit provides a checksum. The checksum is a complicated mathematical expression using the first eight digits. If the end result does not equal the checksum number, the transaction is flagged and rerouted for manual processing.

Bank Routing Number Lookup Bb&t

The ABA's Role in Check Processing

Bank Routing Number Lookup Keybank

Since the 1960s, the ABA number has played an instrumental part in significantly speeding up check processing. Additionally, with the passage of the Check 21 Act in 2004, physical checks that needed to travel by airplane and truck to reach banks could now be submitted and cleared electronically. This means that funds can clear almost instantaneously, and consumers no longer have the luxury of 'playing the float,' or issuing a check a few days before they actually have the funds in their account.